Boost Your Credit Score Regardless of Your Age

Posted on Apr 17, 2018

Credit scores are important and people are more conscious of their credit scores than ever before. Many are taking more time to review their scores and finding ways to improve them, especially younger consumers who typically have lower credit scores. Why is that the case? The information below delves into this topic and outlines ways for consumers...

Boost Your Credit This Year

Posted on Apr 03, 2018

Good credit pays off. Even if you’re not planning to borrow money to make a large purchase, good credit may qualify you for better insurance rates, help you avoid paying security deposits when you sign up for new cell phone service or even help you negotiate a better rate on a vacation rental.

The information I’m sending this month not only outlines...

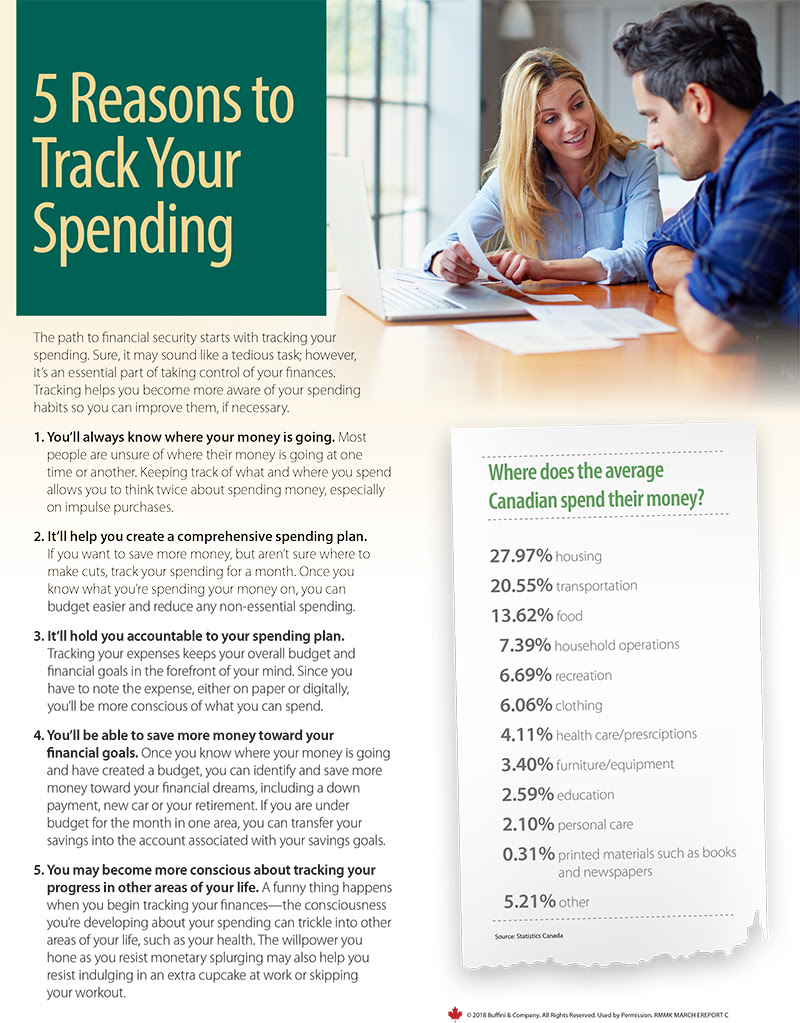

5 Reasons to Track Your Spending

Posted on Mar 12, 2018

Many of us ask ourselves, “where did my money go?” When you track your expenses, you’ll never need to ask this question again. Below are five reasons to track your spending, if you’re not doing so already. If you want to take control of your finances and build wealth, expense tracking is a great place to start.

Do you want help developing your financial strategy? You may need a planner.

Posted on Feb 28, 2018

It’s a popular misconception that only multi-millionaires benefit from the services of a financial planner. While there are financial professionals who only work with wealthy individuals, many offer their services to people who wish to become millionaires.

The information I’m sending this month will help you discover the benefits of working with a f...

The information I’m sending this month will help you discover the benefits of working with a f...

How to Protect Your Information Online

Posted on Feb 13, 2018

Many of us spend a lot of time online. We shop, use social media to connect with family and friends, send personal and business emails, pay bills and more. This makes it incredibly important to ensure our personal information is safe from thieves. Below are several tips to help you keep your information secure.

How Do You Secure Your Information Following Theft?

Posted on Feb 04, 2018

As more people rely on the internet to shop, bank, file taxes and more, thieves are finding more ways to steal personal information. While many people take the necessary precautions to keep their details safe, thieves may still be able to attain personal information by hacking into the systems of larger businesses. How can you make sure you’re secu...